TDSMAN is a comprehensive software that helps in preparing Error-Free TDS & TCS Returns.This has been designed as per the system guidelines and requirements of the Income Tax Department, Govt. of India. The software enables TDS & TCS compliances for all types of Forms – 24Q, 26Q, 27Q, 27EQ.

As part of the TDS eco-system, simplified preparation of Form 24G by Pay and Accounts Office (PAO), District Treasury Office (DTO) and Cheque Drawing and Disbursing Office (CDDO) is also available.

Power Packed Convenience

- The software covers current financial year and all previous financial years

- Preparation of TDS & TCS Returns & Correction Statements (Forms 24Q, 26Q, 27Q, 27EQ)

- Supports unlimited Deductors / Companies

- Limit on no. of Deductee / Employee Records – based on selection of Edition

- Convenient & easy to use interfaces

- Generation & printing of various types of utility reports in PDF, Word & Excel formats

- Multi user option with definable access restrictions

- Auto update option Trial to License

- Deductees entry without challan

Data Import / Export Features

- High-speed Data Import Excel & CSV

- Export Data to Excel & CSV

- Import of Company Information from Conso (TDS)

- Data migration from previous TDSMAN versions

- Data import from TXT & Conso file

- Import Challans directly from TRACES

Default Analysis

- PAN Verification & Name Extraction

- Check for ‘Inoperative’ status of PAN

- Challan validation

- Auto TDS / TCS Calculator

- Short Deductions

- Late Payment – Interest calculation

- Late Deduction – Interest calculation

- Late Fee Calculation

Return Generation

- FVU file generation in just one click with the integrated File Validation Utility (FVU)

- Option to automatically download CSI file

- Instant display of the file validation errors

- Option to display of FVU errors in a structured format with facility to pin-point error records in Return data

- Filing of Return (IT Portal)

- Online Return Filing

TDS Certificates

- Downloading of TDS / TCS Certificates

- Generation & Printing of TDS / TCS Certificates

- Merge PDF Form 16 Part A and Part B

- Email TDS / TCS Certificates

Interfacing with TRACES & IT Portal

- Integration with TRACES & IT Portal

- Automated TRACES Requests / Download of Conso File, Defaults, Certificates, etc.

- Challan auto fill-up on IT Portal

- Validation of Challan data from TRACES / IT Portal

- Import of Challan data from TRACES / IT Portal

- Challan Addition, PAN Correction, Challan Correction

- View of Challan Status, Defaults, Statement Status Credits among others

- Validation of Certificate 197

- Online filing of TDS / TCS Returns – IT Portal

- Download of TRACES Utilities – PDF Convertor, Justification Reports, etc.

Correction Statements

- Preparation of Correction Returns of all permissible types

- Import of data from Conso (TDS) file downloaded from TRACES

- Colour highlighting in Correction Return for easy identification

- To simplify your corrections, software retains the original values for later reference

- Nullify ‘All Deductees’ with one click

- Bulk Deductee / Employee addition

- Bulk PAN modification through Excel, CSV

- Bulk Nullify through Excel, CSV

Useful Utilities

- Save image of Filing Receipt

- Data Backup and Restore facility

- Auto Backup option

- Upgrade to next financial year without re-installing software

- Form 3CD report [TDS section]

- Pay TAX online – Auto Fill

- Option for finding BSR codes

- Monthly TDS calculator for Salary

- View BIN Information Online

- View Challan information online

- Compliance check for Sections 206AB & 206CCA

- TDS / TCS – Rate Chart

Easy & Seamless Usage

- Facility to auto update the Software

- Auto update of File Validation Utility

- Compliance Reminders & Alerts

- Software is provided with User Manual, Video Demo for easy understanding

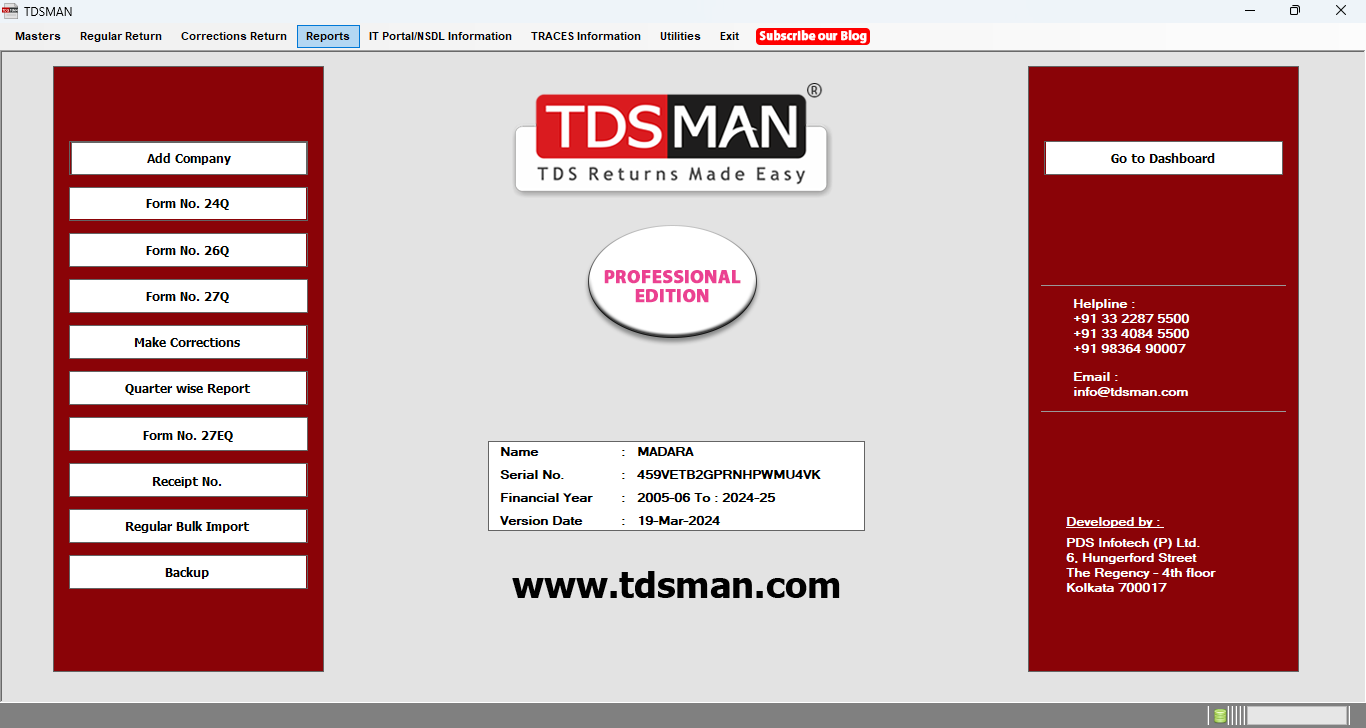

Screenshots

Downloads